Why INVESTIDO?

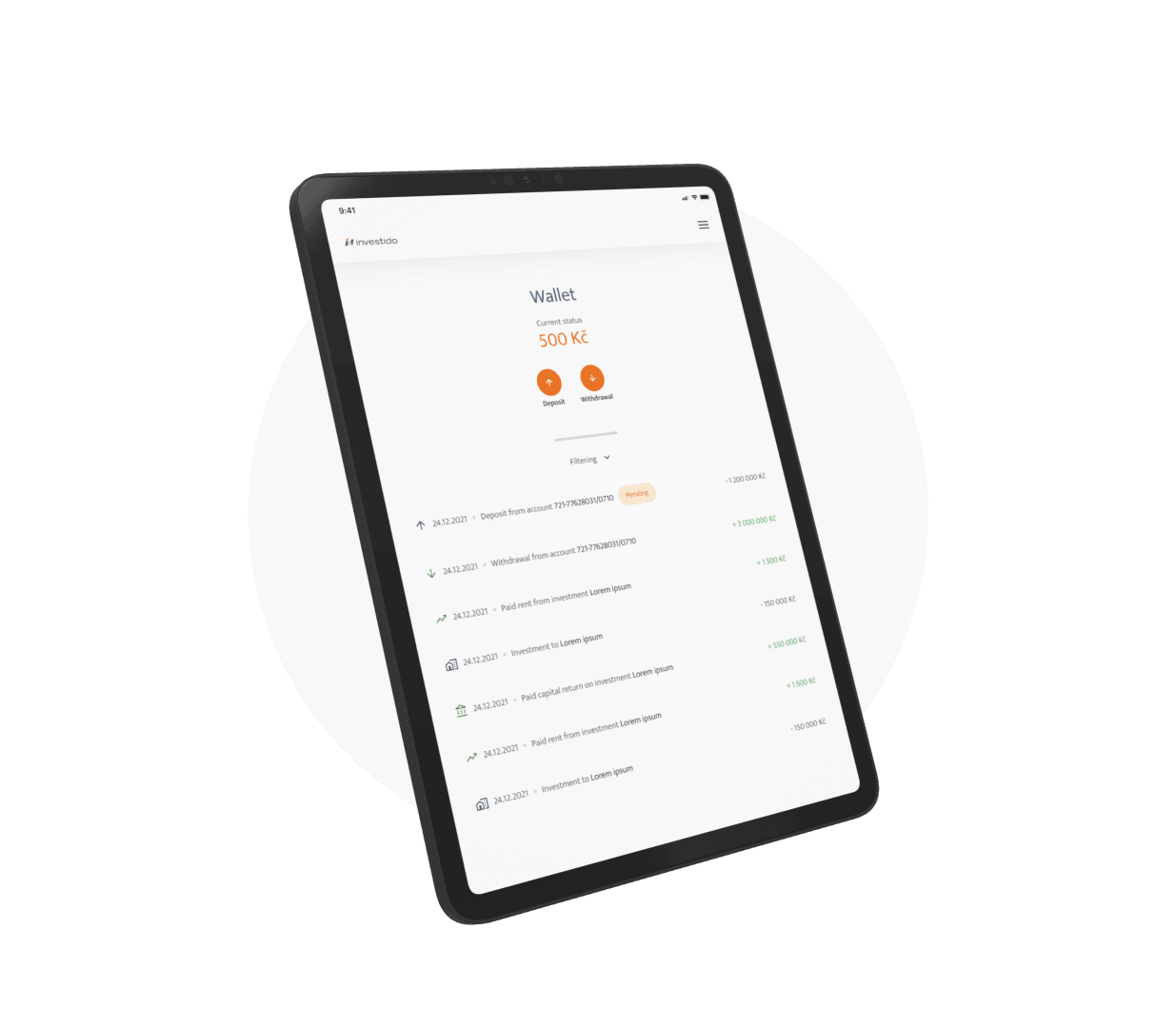

You have the opportunity to invest online starting from 500 CZK. The minimum investment amount is set so low in order to make regular investing available to you so that you can supplement your investment portfolio with another interesting investment product.

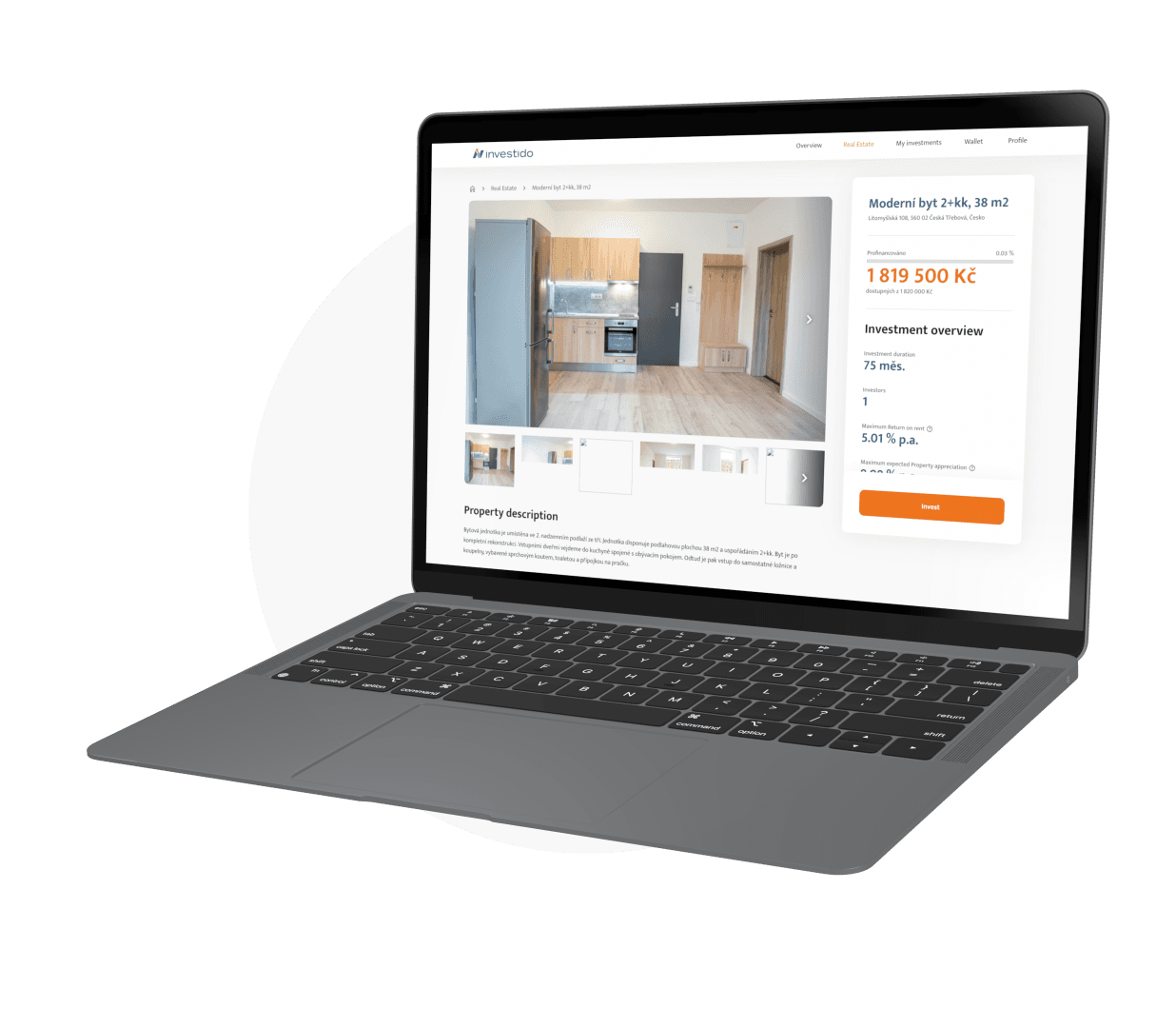

You can choose the property on which the return of your investment is based, for example, by region, length of investment, the layout of the apartment, or simply because you like the apartment.

Our offer is wide so you do not have to worry that there will be nothing to choose from. Consider your options and experience a similar feeling that all landlords experience, without the hassle and worry!

Investments for everyone

You have the opportunity to invest online starting from 500 CZK. The minimum investment amount is set so low in order to make regular investing available to you so that you can supplement your investment portfolio with another interesting investment product.

You can choose the property on which the return of your investment is based, for example, by region, length of investment, the layout of the apartment, or simply because you like the apartment.

Our offer is wide so you do not have to worry that there will be nothing to choose from. Consider your options and experience a similar feeling that all landlords experience, without the hassle and worry!

Before you start the real investment, you will sign an online loan participation agreement with us as part of the client verification process, which will retroactively finance the property. In addition to the General Contract, a Partial Contract of Participation is also concluded for each investment, which always relates to a specific property. We value our clients and pride ourselves on a fair approach. Thus, when investing, we will create a lien on each participation for the claim (as stated in the contract).

Under the Partial Contract of Participation, a lien is created on your claim. If necessary, you can then sell your participation on the secondary market. All properties are insured and policies are reviewed annually.

Investments in safety

Before you start the real investment, you will sign an online loan participation agreement with us as part of the client verification process, which will retroactively finance the property. In addition to the General Contract, a Partial Contract of Participation is also concluded for each investment, which always relates to a specific property. We value our clients and pride ourselves on a fair approach. Thus, when investing, we will create a lien on each participation for the claim (as stated in the contract).

Under the Partial Contract of Participation, a lien is created on your claim. If necessary, you can then sell your participation on the secondary market. All properties are insured and policies are reviewed annually.

- Monthly payment of a share of the rent,

- The appreciation of the property over time, which you will learn more about below.

Your invested money is appreciated in two ways:

The higher the amount you invest, the higher the share you get.

Regular returns

- Monthly payment of a share of the rent,

- The appreciation of the property over time, which you will learn more about below.

Your invested money is appreciated in two ways:

The higher the amount you invest, the higher the share you get.

Another way of appreciation, which INVESTIDO, as the only one on the market, offers its investors, is the appreciation of the property over time. This is the difference between the amount of the loan provided and the subsequent sale price at the end of the investment period. Our team has years of experience in finding undervalued and attractively priced properties, which may mean a lower purchase price for you and thus a higher profit on the expected appreciation of the property. It surely cannot have escaped your notice that property has been increasing in value over the last decade. In some cases by hundreds of percent.

To give you an idea, here are the average prices of real estate in the Czech Republic according to price maps in the time range from 04/2012 to 04/2022.

In April 2012, the average price of a 1+1 apartment was approximately CZK 933,000, and in April 2022 it was CZK 2,672,000. The average price of a 2+1 apartment was around CZK 1,351,000 in April 2012 and CZK 3,695,000 in April 2022.

Property appreciation

Another way of appreciation, which INVESTIDO, as the only one on the market, offers its investors, is the appreciation of the property over time. This is the difference between the amount of the loan provided and the subsequent sale price at the end of the investment period. Our team has years of experience in finding undervalued and attractively priced properties, which may mean a lower purchase price for you and thus a higher profit on the expected appreciation of the property. It surely cannot have escaped your notice that property has been increasing in value over the last decade. In some cases by hundreds of percent.

To give you an idea, here are the average prices of real estate in the Czech Republic according to price maps in the time range from 04/2012 to 04/2022.

In April 2012, the average price of a 1+1 apartment was approximately CZK 933,000, and in April 2022 it was CZK 2,672,000. The average price of a 2+1 apartment was around CZK 1,351,000 in April 2012 and CZK 3,695,000 in April 2022.

According to your chosen investment strategy, you set the percentage ratio between the share of the rent and the share of the expected property appreciation. For example, if you want to bet more on certainty, we will set our strategy as follows: 70% of the invested amount will be a share of the rent and 30% of the required profit will be a share of the expected appreciation of the property.

We will periodically value the property according to price maps so that you have a realistic idea of how your investment is developing. At the end of the investment, we will have each property professionally revalued. The property will then be sold or re-offered for financing at the current market price. In either case, your share of the property appreciation will be paid to you (no later than 2 months after the end of the investment).

Only clients who hold a share in the property at the end of the investment will be entitled to receive a payment from the property appreciation. It is therefore worth being patient or purchasing a beneficial interest from another investor in the secondary market.

How does it work?

According to your chosen investment strategy, you set the percentage ratio between the share of the rent and the share of the expected property appreciation. For example, if you want to bet more on certainty, we will set our strategy as follows: 70% of the invested amount will be a share of the rent and 30% of the required profit will be a share of the expected appreciation of the property.

We will periodically value the property according to price maps so that you have a realistic idea of how your investment is developing. At the end of the investment, we will have each property professionally revalued. The property will then be sold or re-offered for financing at the current market price. In either case, your share of the property appreciation will be paid to you (no later than 2 months after the end of the investment).

Only clients who hold a share in the property at the end of the investment will be entitled to receive a payment from the property appreciation. It is therefore worth being patient or purchasing a beneficial interest from another investor in the secondary market.

The secondary market is where supply meets the demand of our investors who have the need to either sell or buy their stake. Clients who need to get their funds back early can offer their share for sale on the secondary market. The fee for selling a share is 1.5% of the amount invested and the client also loses the right to receive their share of the property appreciation.

On the other hand, clients who wish to purchase a share on the secondary market will have the opportunity to acquire it with a shorter investment horizon than that indicated in our offer of properties for financing and, among other things, will receive an increase in the expected property appreciation from the beginning of the investment.

Secondary market

The secondary market is where supply meets the demand of our investors who have the need to either sell or buy their stake. Clients who need to get their funds back early can offer their share for sale on the secondary market. The fee for selling a share is 1.5% of the amount invested and the client also loses the right to receive their share of the property appreciation.

On the other hand, clients who wish to purchase a share on the secondary market will have the opportunity to acquire it with a shorter investment horizon than that indicated in our offer of properties for financing and, among other things, will receive an increase in the expected property appreciation from the beginning of the investment.

You can set your investment strategy according to your needs, possibilities and expectations. The range of the investment strategy can be set between 20% - 80% of the return on the expected property appreciation so that the sum is always 100%. The investment ratio can take various forms (e. g. 30/70, 50/50, 75/25, etc.). For each new investment, the strategy will default to an 80/20 ratio, or your returns will be 80% of the share of the rent and 20% of the share of the expected property appreciation. However, you always have the option to change this strategy at the beginning.

Investment strategy

You can set your investment strategy according to your needs, possibilities and expectations. The range of the investment strategy can be set between 20% - 80% of the return on the expected property appreciation so that the sum is always 100%. The investment ratio can take various forms (e. g. 30/70, 50/50, 75/25, etc.). For each new investment, the strategy will default to an 80/20 ratio, or your returns will be 80% of the share of the rent and 20% of the share of the expected property appreciation. However, you always have the option to change this strategy at the beginning.